Private Capital Firms Sink on Trump Tariffs

Shares of the largest US private equity firms, including KKR, plummeted on Thursday following President Donald Trump’s tariff announcement

Translate

Bloomberg may send me offers and promotions.

By submitting my information, I agree to the Privacy Policy and Terms of Service.

Welcome to Going Private, Bloomberg’s twice-weekly newsletter about private markets and the forces moving capital away from the public eye. Today, we’re looking at the immediate effects the Trump administration’s tariffs are having on private equity and private credit firms. Plus, the financing for Clearlake’s planned acquisition of Dun & Bradstreet — Isabella Farr

If you’re not already on our list, sign up here. Have feedback? Email us at goingprivate@bloomberg.net

Gut Punch

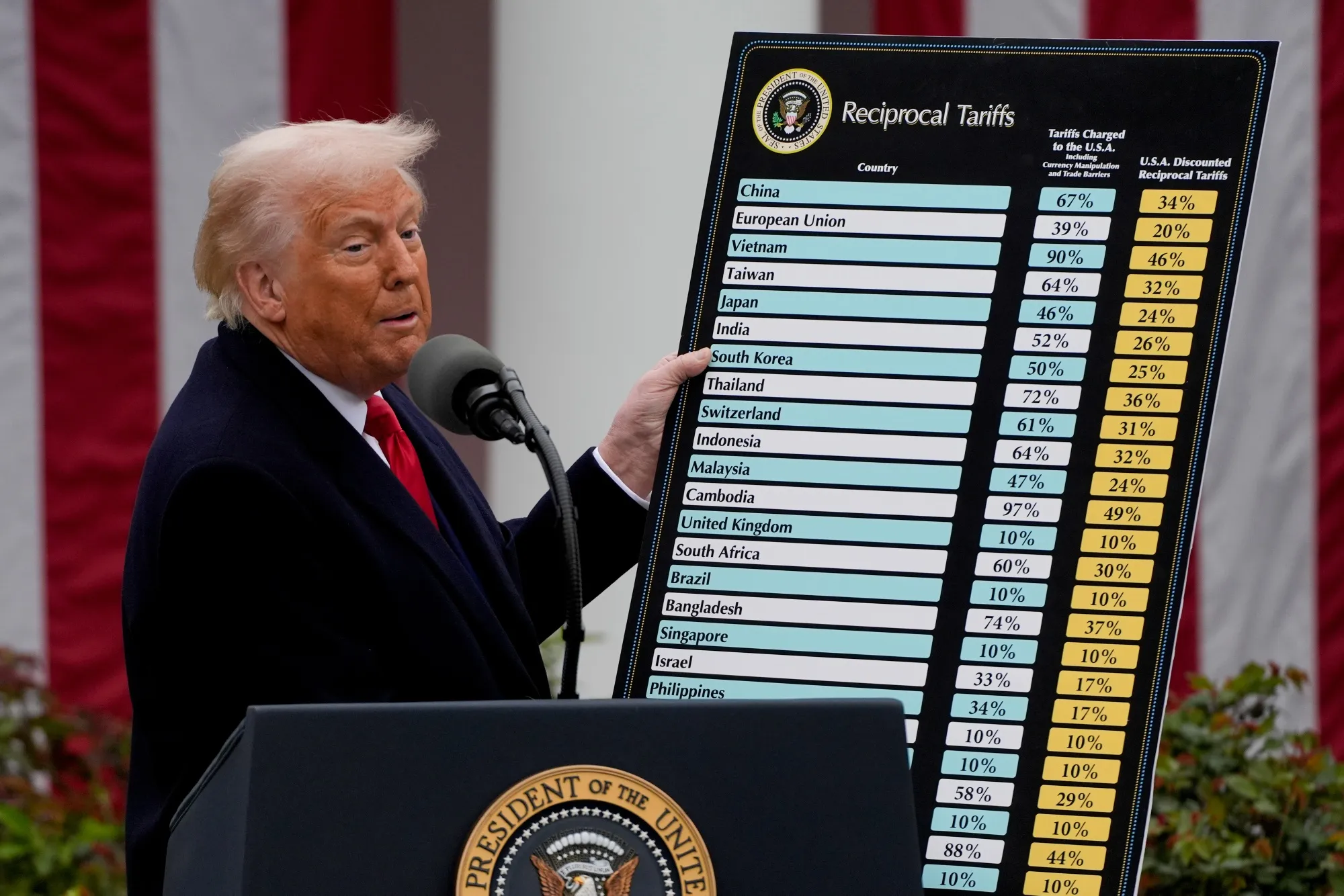

KKR had been on a nearly 15-year streak: its share price had never dropped more than 15% in a single trading day. That was, until Thursday, the day after President Donald Trump announced sweeping, hefty tariffs across the world.

Shares of the largest US private equity firms, including KKR, plummeted on Thursday, as my colleague Laura Benitez reported.

Shares of the Biggest Private Equity Firms Plunge

Percentage change compared to market close on March 3

Source: Bloomberg

Data is normalized with percentage appreciation as of March 3, 2025.

KKR and Ares Management both tumbled 15%, marking the biggest drop since they went public (KKR went public in 2010, while Ares did so in 2015). Shares of Apollo Global Management and Carlyle Group also saw their worst drops since March 2020.

Some private credit funds also took a hit on Thursday. Blue Owl Capital’s stock dropped more than 15% on Thursday.

Private equity firms have been desperate for a flood of mergers and acquisitions, and were hoping lighter regulation from the Trump administration would be enough kindling. That hasn’t happened.

Now, companies sitting in private equity portfolios risk seeing huge hits from Trump’s tariffs, especially those with supply chains that largely rely on imports or overseas manufacturing.

But private equity firms have to ask themselves: just how exposed are our portfolio companies?

Law firm Akin Gump has been fielding calls from buyout shops trying to understand how tariffs will affect their corporates, my colleagues Hema Parmar, Gillian Tan and Allison McNeely reported.

Unless companies are global businesses focused on services or software, or with entirely domestic supply chains, dealmakers at private equity firms are also hesitant to bring transactions to their investment committees, my colleagues reported.

Rushed Financing

When Clearlake Capital Group closed in on a deal to buy Dun & Bradstreet, one of Wall Street’s oldest providers of data and analytics, it needed to do so fast.

The problem: lining up a traditional financing package for the acquisition would have taken weeks. So, the private equity firm took what it could get on short notice — a $5.75 billion, 364-day bridge loan from a group of banks that offered none of the guarantees that usually come with an underwritten LBO, my colleagues Irene García Pérez, Gowri Gurumurthy, Jeannine Amodeo and Ryan Gould reported.

That loan may have helped Clearlake win the deal, but the firm must now secure more permanent financing. Given the turbulence across credit markets as the trade war ramps up, this may be initially challenging.

But it faces risks. Banks aren’t obliged to find longer-term funding to take the risk off their books, and if Clearlake uses the short-term loan, the borrowing costs ramp up over time.

Lobster Investing

Private equity and private credit might be the standard non-public assets investors can cash into. But what about, a lobster-fishing license?

One of Australia’s largest independent wealth advisers, Koda Capital, is expanding the sorts of alternative private investments it can offer to wealthy clients, Harry Brumpton reported.

The firm is pushing up clients’ exposure to funds that hold stakes in assets like airports or mobile phone towers, or invest in venture capital. As part of that push, Koda has become the largest institutional investor in fishing licenses.

It has more than A$400 million in such products, making up 4% of its core private client portfolios, Koda’s chief investment officer, Norman Zhang, told Brumpton.

Many alternative asset managers are looking for paths to expand their private credit reach. But generally, they’ve taken on more conventional or established lending markets.

In the US, for example, direct lenders are eyeing the country’s $50 trillion housing market, my colleague Carmen Arroyo reported.

Two specific products of interest are home equity loans and lines of credit, through which homeowners can borrow against their value of their property and score additional credit without refinancing their existing mortgages. TPG Angelo Gordon has estimated these products could be a $2 trillion market.

In Their Words

The Number

- $55 billionThe combined loss in market capitalization for Apollo, Ares, Blackstone, KKR and Carlyle during Thursday's selloff.

Movers and Shakers

Apollo has hired Matt Faranda as part of its effort to build out its private credit trading arm, as Laura Benitez reported.

Faranda will join Apollo as a managing director in its private credit liquidity solutions business, and will report to John Maggiacomo. He previously spent more than eight years at StoneCastle Securities, where he ran credit trading.

Apollo isn’t done with its hires. It’s expected to add more people as it expands its sales and trading functions across corporate and asset-backed private credit. Its working on building a marketplace to make it easier to trade high-grade private assets.

What’s Keeping Us Busy

- Rippling, the business software company at the center of a theatrical Silicon Valley espionage drama, is in early talks to raise hundreds of millions of dollars at a valuation of about $16 billion.

- Thoma Bravo is exploring expanding its Miami footprint and is in talks to move its office to the Design District from Brickell as it pursues more space

Thank you for reading Going Private, Bloomberg’s twice-weekly newsletter on private markets. Contact us for feedback and tips at goingprivate@bloomberg.net.

More From Bloomberg

Like Going Private? Check out these newsletters:

- The Brink for exclusive coverage of corporate distress, bankruptcies and turnaround stories

- Markets Daily for what’s moving in stocks, bonds, FX and commodities

- CFO Briefing for what finance leaders need to know

- Money Stuff for Bloomberg Opinion’s Matt Levine’s newsletter on all things Wall Street and finance

- Deals for the latest news and analysis, from IPOs to startup investing

You have exclusive access to other subscriber-only newsletters. Explore all newsletters here to get most out of your Bloomberg subscription.

Comments

Post a Comment