‘America First’ Is Making Emerging Markets No. 1

The trend is real and increasingly looks like it has legs.

Bloomberg may send me offers and promotions.

To get John Authers’ newsletter delivered directly to your inbox, sign up here.

Today’s Points:

- Emerging markets are on a roll, again.

- The big proxy advisers face a US antitrust investigation.

- October economic data are unlikely ever to appear, says the White House.

- Options traders appear to be driving the dash for small-company trash.

- It’s official — the US government shutdown is over.

- AND: Another dose of anti-government music.

Emerging Waves

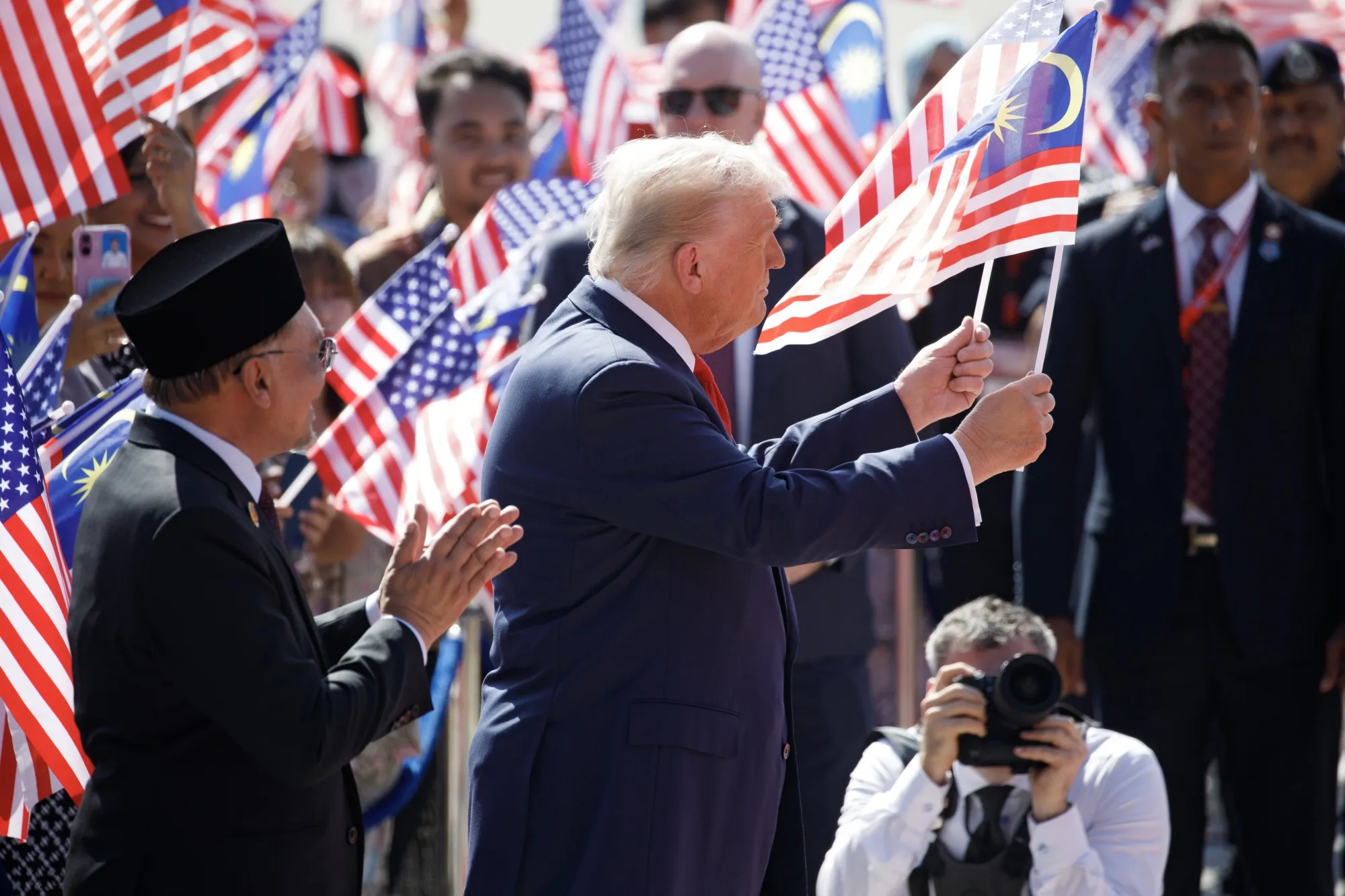

The sustained appeal of emerging market assets since the turn of the year has more to do with Washington’s “America First” philosophy than anything else. The administration wants a weaker dollar, it tends to get what it wants, and a declining greenback helps the emerging world. That ideological shift has unfolded as a steady recalibration, not an abrupt change of course. The intriguing question now is whether it prefigures a broader sea change.

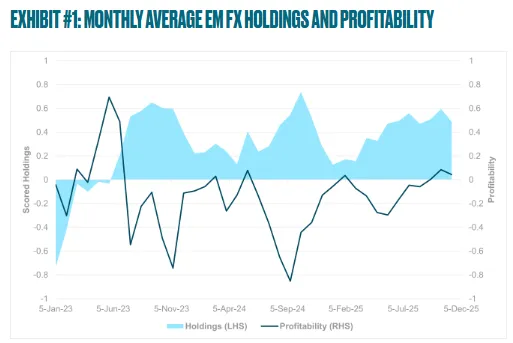

The bumpy ride is illustrated by the latest Institute of International Finance capital flows tracker, which shows that EM portfolio flows rebounded in October after a subdued outing the prior month. Equity allocations snapped their three-month streak of weakness, which had been weighed on by tariff uncertainty and wavering investor confidence:

EM Equity Flows Steady, Not Linear

Opportunities outside developed markets fragile, prone to policy shocks

Source: Institute of International Finance

Regardless, the year-to-date performance, as the following chart highlights, can be viewed as a renewed sense of optimism in EM equities:

Emerging Winners

Initially buffetted by the US election result, EM has steadily taken the lead

Source: Bloomberg

Data is normalized with factor 100 as of November 5, 2024.

As encouraging as the equity gains may be, history offers some perspective. Dating back to the early 2000s, past cycles suggest they still have a long way to go before reclaiming their former glory. This is how MSCI’s emerging markets index has performed relative to its EAFE index (for Europe, Australasia and Far East — an index of non-North American developed markets):

Emerging Waves

In the 30 years since the Tequila Crisis, EM has fared no better than EAFE

Source: Bloomberg

Note: 12/31/1987 = 100

The current EM rally is the most convincing since the splurge of optimism about China in the immediate aftermath of the pandemic’s first wave in 2020. That dissipated as Covid disruptions dragged on and investors lost patience with Xi Jinping’s crackdown on the private sector. If there’s a way to gauge whether the latest burst of optimism can be more sustained, it starts with understanding what drove earlier upswings and how powerful those forces proved.

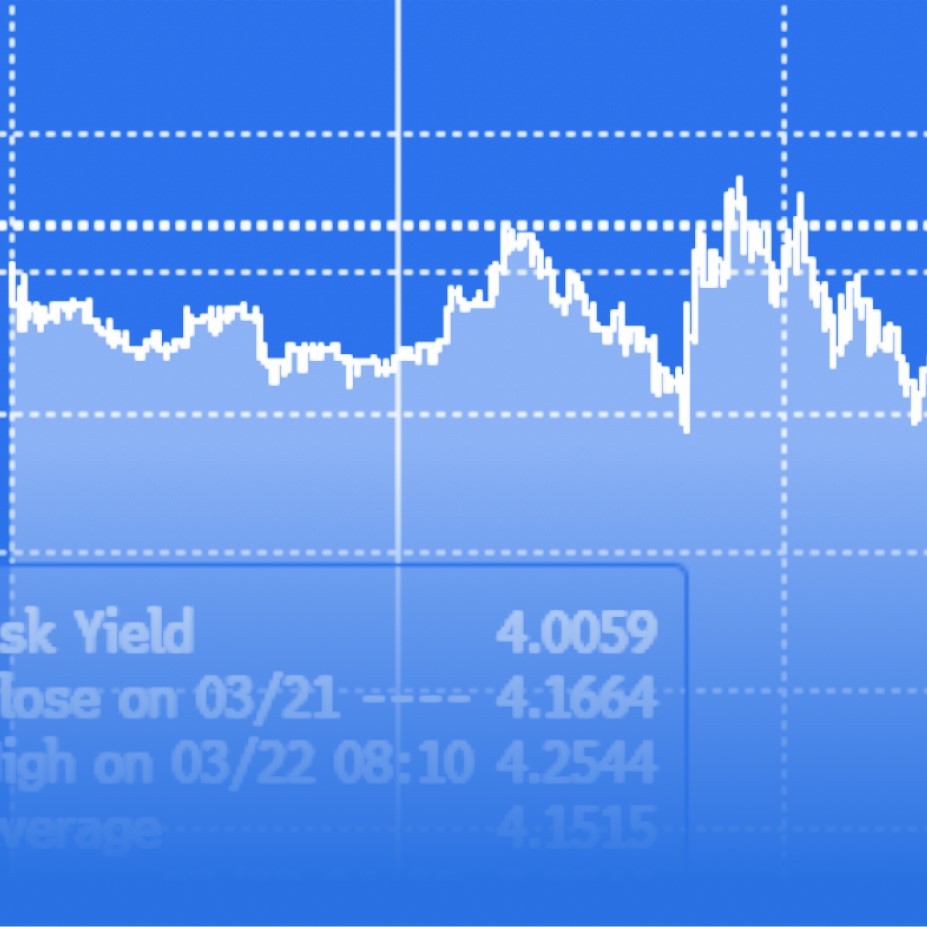

One element, as ever, is the weaker dollar, which boosts local-currency returns, eases any problems funding dollar-denominated debt, and lifts sentiment across developing economies. As this BNY chart illustrates, this cycle may still have room to run, particularly if the Federal Reserve follows through with further cuts amid signs of a softening labor market:

The trend looks as though it might have turned. JPMorgan’s index of EM currencies against the dollar, the most widely used benchmark, troughed at the turn of the year and has stayed above its 200-day moving average throughout months of uncertainty. Forex traders watch such technical trends closely, and this will bolster other EM assets if it holds:

Was That the Bottom?

Emerging currencies are making their most convincing rally in five years

Source: Bloomberg

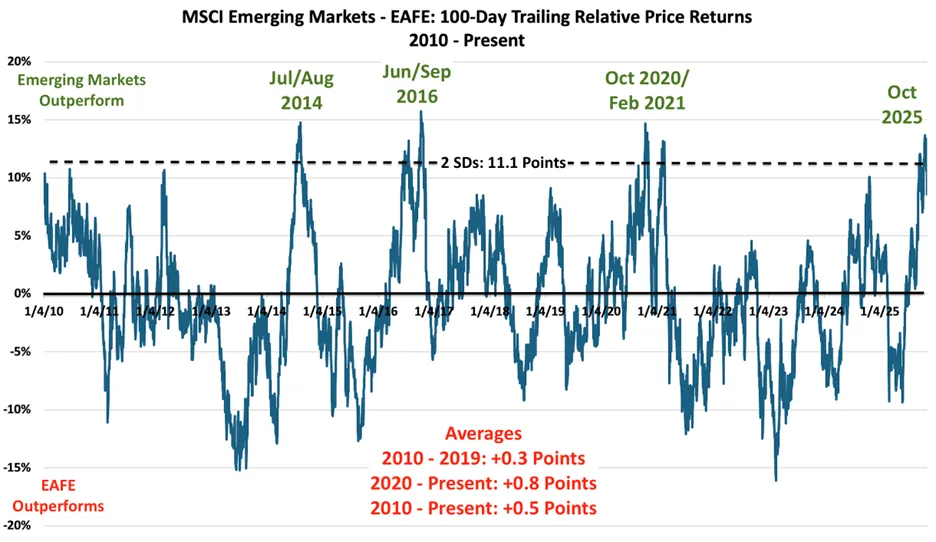

Beyond that, Nicholas Colas of DataTrek Research’s chart of MSCI EM’s relative performance to EAFE using rolling 100-day price returns since 2010 shows emerging markets outperforming their developed peers by more than two standard deviations. That is statistically significant, and confirms this is their most convincing rally since the short-lived excitement over China five years ago:

As this has happened on only six occasions in the last 15 years, it underscores the significance of the push into EMs, rather than Europe and Japan, as a primary alternative to the US. They might just be the greatest market beneficiaries from Trump 2.0.

But Colas also shows that while such outperformance is likely to persevere after breaking out like this, history suggests that it will be by a much smaller margin. Another key point, compared to previous cycles, is that the companies you buy have changed. The sectoral differences between EAFE, still dominated by traditional manufacturing powerhouses, and emerging markets are growing deeper. This speaks to the chance of the rally persisting:

To be overweight in the emerging markets — home of the likes of Huawei, Xiaomi and TSMC — rather than EAFE is to be overweight in tech (by 18.6 points). It also involves being heavily exposed to China and Taiwan. This proves two things. First, investors’ desire to diversify away from the US isn’t driven by worries about tech concentration risk there. Second, Beijing’s sparring with Washington still threatens to disrupt the sector. Even amid the fragile calm of the latest trade truce, it suggests that investors might be taking rather more of a geopolitical risk than they realize.

This revival could be thwarted if the tech bubble bursts or the AI buildout doesn’t go as planned. The key to the real question of whether EM is at last at the beginning of a sustained up-cycle depends on whether the ongoing “de-risking” from China amounts to a sustainable strategy. That still involves much longer-term prognoses.

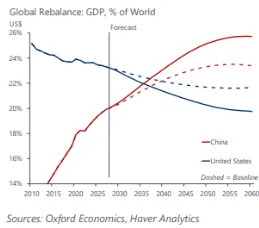

Oxford Economics’ Benjamin Trevis argues that it might, if seen through the lens of a broader global rebalancing that envisions a shift from today’s dollar-dominated, unipolar order to one anchored by the US and China.

His scenario assumes persistent US fiscal deficits, attempts to eliminate the trade gap, and political interference in monetary policy, alongside Chinese efforts to build technological dominance and move toward financial liberalization. Together, these forces would gradually create a dual-power economic order:

Under this scenario, confidence in US assets wanes into the 2030s as Treasury debt surpasses 180% of gross domestic product and repeated political interference with the Fed eats away at its credibility. Investor trust erodes, capital flows reverse, risk premia rise, and the dollar weakens by around 20%, with the US losing the “exorbitant privilege” that comes with the reserve currency.

Trevis’s predictions for China under this scenario sound more ambitious:

China pursues successful reforms, loosening capital controls and improving transparency. A better pension system reduces the need for precautionary savings, and the personal savings-to-disposable-income ratio falls to around 10% by 2060. Domestic consumption is 14% higher than the baseline in real terms by 2060, aligning China with advanced economies.

That sounds far-fetched, and it’s worth remembering that not long ago China was broadly dismissed as “uninvestable.” There’s nothing to indicate that a wholesale rebalancing of the global financial system is imminent — and hence there are many obstacles to any long-term emerging market wave.

But some version of Trevis’s narrative could underpin such a wave, just as excitement about China’s entry to the global trade system and the commodity boom it inspired drove the last one. With a few more small wins, the story could yet take on a life of its own.

—Richard Abbey

Indiscriminate Markets

Just how discriminating are investors these days? Not very. The evidence appears at both ends of the spectrum. Among the larger stocks in the S&P 500, concentration has risen dramatically since the advent of ChatGPT three years ago sparked the AI boom. That’s illustrated by the success of the cap-weighted version of the S&P 500, ever more dominated by the Magnificent Seven tech giants, over the equal-weighted version in which each stock counts for the same regardless of size:

The average stock has barely improved this year. This possibly means that the investment in AI is displacing funds that would otherwise have flowed elsewhere. Or it might point to incurious buying of the index, which will tend to stoke the concentration that already exists. One reader commented to me:

I asked a broker [at one of the biggest US retail firms] two days ago where I could find the holdings for GDX, a gold miners ETF. He commented that it had probably been at least a year since anybody had asked him for the holdings for any ETF.

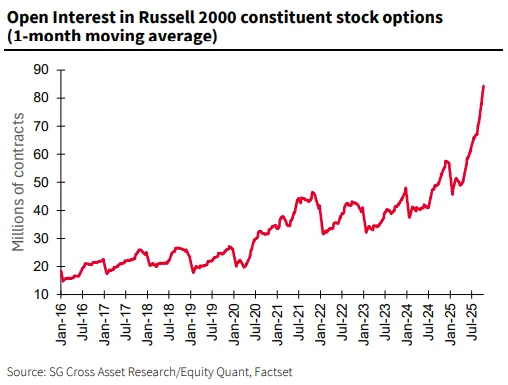

At the other end of the spectrum, those not just sinking money passively into large caps are speculating using options on single small-cap stocks. Andrew Lapthorne of Societe Generale shows that volume in options tied to the Russell 2000 has gone through the roof this year:

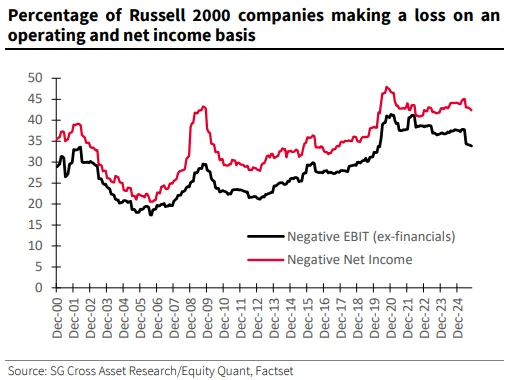

This is odd because, as Points of Return covered yesterday, a lot of companies in the Russell 2000 don’t earn a profit, so betting on them is all the riskier. This chart, also from Lapthorne, shows that as many as 40% make a loss:

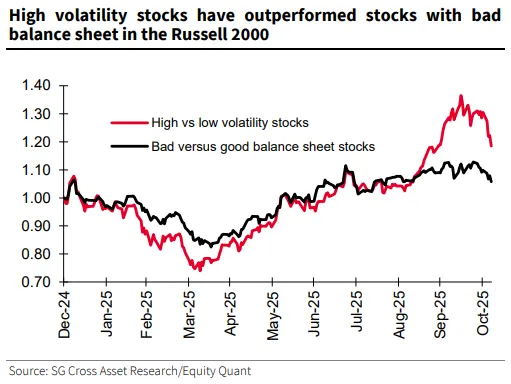

The stocks attracting the most options activity are those that are already the most volatile, making any such investment potentially lucrative but also very risky. And Russell 2000 companies with relatively poor balance sheets (of which there are many) are outperforming stronger companies:

It’s hard to see behavior like this as the result of a careful balancing of risks, or an attempt to channel capital where it can be most productive.

Both passive investing in big companies and active investment in smaller stocks prove on closer examination to be indiscriminate and unduly risky. This is sustainable while the rally lasts. Thereafter…

Something for the Weekend

The government is investigating ISS and Glass-Lewis on potential antitrust charges. They are the two biggest proxy advisers, who between them dominate the business of counseling fund managers on corporate governance. There’s a case to answer. But there is a risk that without a few coherent voices to unify shareholders, company executives will find themselves with their own unhealthy degree of control. I’ll be exploring this more in the Weekend Essay, coming to the website on Friday. Please give it a read.

Survival Tips

So we have more anti-government songs for you. Those who remember Margaret Thatcher might try Billy Bragg’s Ideology, or Maggie’s Farm as performed by The Specials. For more Vietnam-era anger, try Ohio by Crosby Stills & Nash, Monster/Suicide/America by Steppenwolf, Jimi Hendrix’s version of Star-Spangled Banner or (also from Woodstock) Volunteers of America by Jefferson Airplane and Feel Like I’m Fixing to Die Rag by Country Joe McDonald. Or there’s What’s Up by 4 Non-Blondes, or Testify by Rage Against the Machine. One last call for angry songs?

More From Bloomberg Opinion

- Buffett’s Latest Letter Subtweets His Fellow Billionaires: Beth Kowitt

- AI’s Power Grab Has to Face Affordability Politics: Conor Sen

- Blowing Up ‘Narco’ Boats Won’t Stop Latin America’s Real Killers: Juan Pablo Spinetto

Want more Bloomberg Opinion? OPIN. Or you can subscribe to our daily newsletter.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters like Markets Daily or Odd Lots.

— With assistance from Richard Abbey

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Comments

Post a Comment